Play around with different home prices, locations, down payments, interest rates, and mortgage lengths to see how they impact your monthly mortgage payments. So you can really crunch the numbers, we’ve included all the typical monthly costs you’ll be responsible for once you own a home. Watch this video to understand what makes up a typical mortgage payment – principal, interest, taxes, and insurance – and how they can change over the life of the loan.Ĭheck today’s rates to see our current interest rates.Your monthly mortgage costs include more than just loan payments and interest. Video – The components of a mortgage payment Like taxes, insurance costs are usually collected and paid from an escrow account.ĭepending upon your property location, property type, and loan amount, you may have other monthly or annual expenses such as mortgage insurance, flood insurance, or homeowner association fees. The part of your monthly payment that pays for homeowners or hazard insurance, which provides protection against losses from property damage due to wind, fire, or other risks.

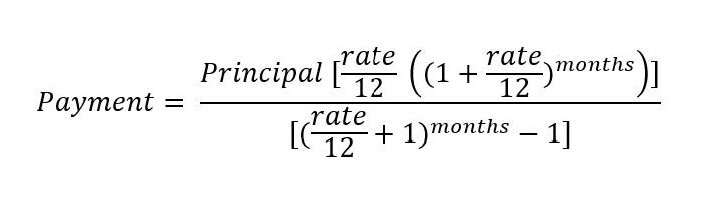

We typically collect a portion of these taxes in every mortgage payment and hold the funds in an escrow account for tax payments made on your behalf as they become due. The part of your monthly payment that goes toward property taxes charged by your local government. The part of your monthly payment that goes toward the cost of borrowing the money. The part of your monthly payment that reduces the outstanding balance of your mortgage. Your monthly mortgage payment is typically made up of four parts: The APR lets you compare mortgages of the same dollar amount by considering their annual cost. This cost is known as the annual percentage rate (APR), which is typically higher than the interest rate. The cost of a mortgage is reflected by the interest rate, discount points, fees, and origination charges. Remember that interest rates only tell part of the story. If you pay off your mortgage balance within a shorter term, you may pay less in total interest than with a longer-term mortgage.Shorter loan terms typically mean higher monthly mortgage payments, but often have lower interest rates.Your loan term is the amount of time you have to pay off your mortgage balance.On refinances, if you qualify, you may be able to finance the origination charge as part of your loan amount.The origination charge covers items including fees, document preparation, and underwriting costs, and other expenses.On a mortgage, this amount includes charges (other than discount points) that all loan originators (lenders and brokers) involved will receive for originating the loan.On refinances you may be able to finance points as part of your mortgage amount. Consult a tax advisor regarding tax deductibility. A lower interest rate means lower monthly mortgage payments. If you qualify, you may be able to pay one or more points to lower your interest rate. One point equals 1% of your mortgage amount however, 1 point will typically reduce the interest rate by less than 1%.Interest rates are based on current market conditions, your credit score, down payment, and the type of mortgage you choose.

Here are some terms you should understand. If you obtain home financing, you’ll repay more than the amount you borrowed because the amount you repay is determined by several factors, including the interest and loan amount.

0 kommentar(er)

0 kommentar(er)